.png?updatedAt=1748432327939)

.png?updatedAt=1748432327939)

.png?updatedAt=1748432327939)

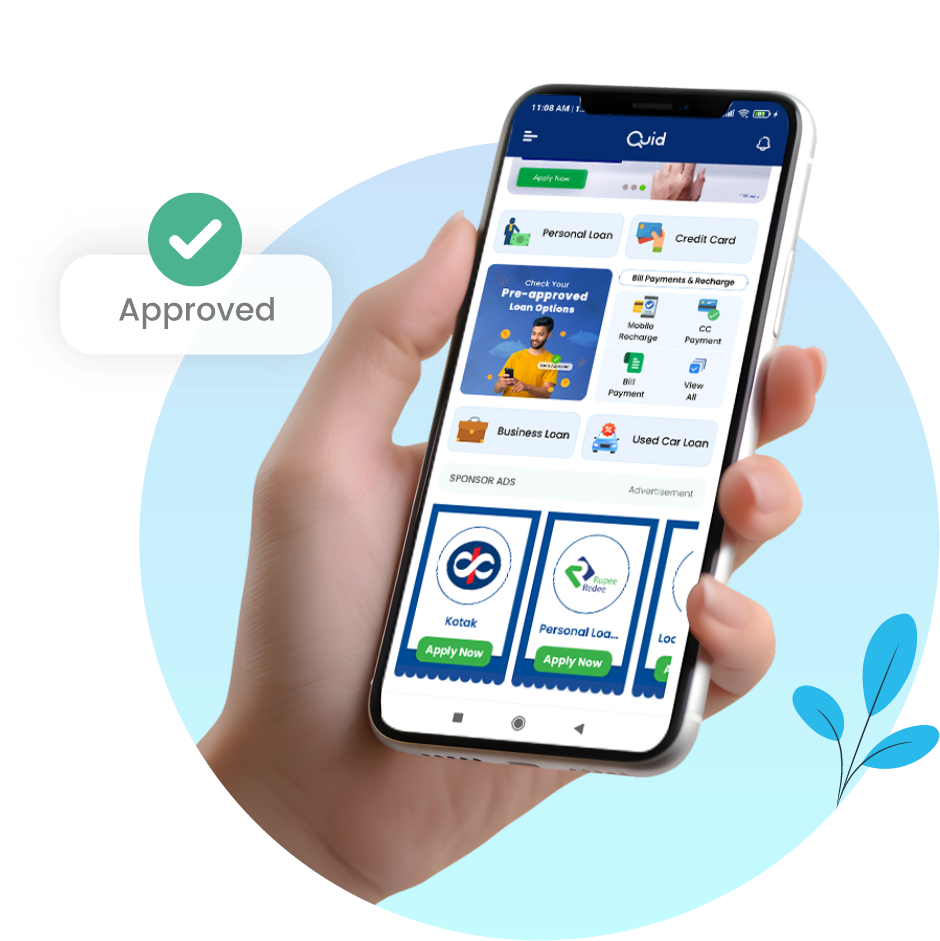

Buy now, pay later. Earn rewards as you

shop, travel, dine, and more!

It’s not that complicated. Discover and choose a credit card that fulfills your unique needs, and apply with a super-easy process.

It’s not that complicated. Discover and choose a credit card that fulfills your unique needs, and apply with a super-easy process.

Disclaimer: Quid.Money is a loan aggregator and is authorized to provide services on behalf of its partners.