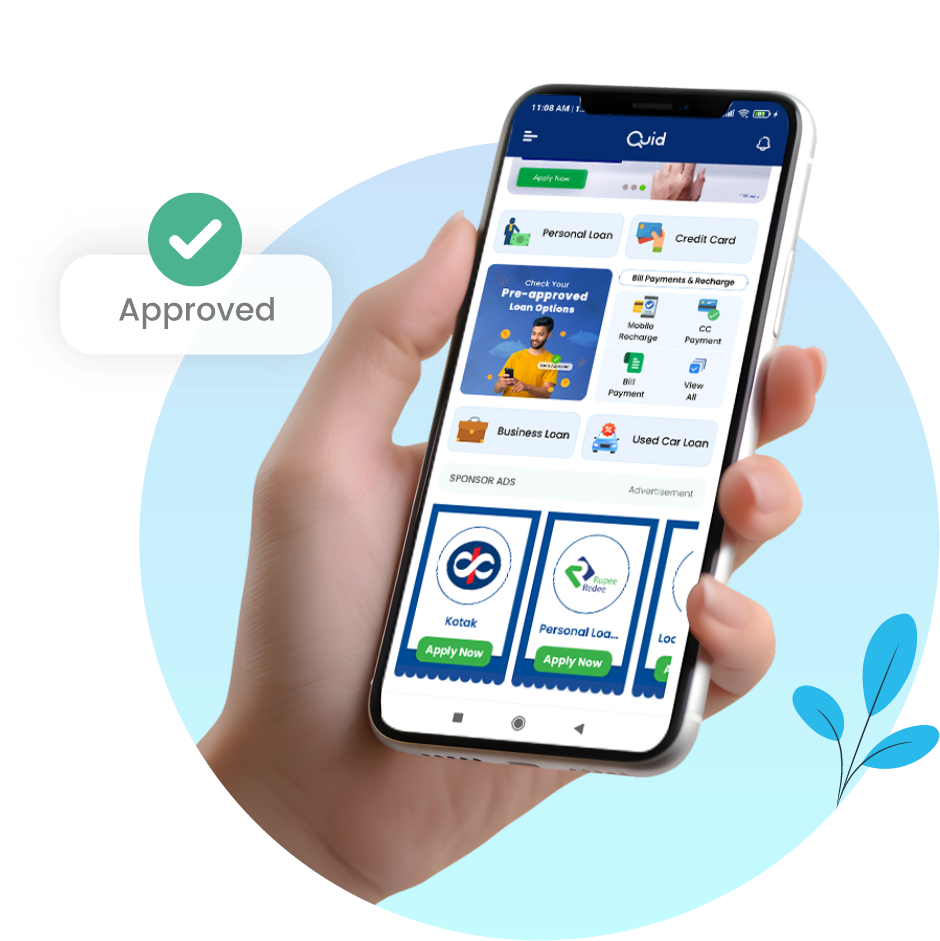

Quid makes applying for a personal loan easier than ever,

with a range of benefits on your side.

Fuel your bigger aspirations

Get your loan amount quickly in your account

Eliminate risk with an unsecured credit facility

Choose to repay in your capacity with a long-tenure

Enjoy a paperless digital process from start to finish

Find more details on the personal offers from

leading banks.

Loan Amount*

Int. Rate*

Loan Tenure

Loan Amount*

Int. Rate*

Loan Tenure

Loan Amount*

Int. Rate*

Loan Tenure

Loan Amount*

Int. Rate*

Loan Tenure

Loan Amount*

Int. Rate*

Loan Tenure

Disclaimer: The interest rate charges are subject to constant change as they are affected by several factors. Please check the prevailing interest rate with your lender before applying.

Find the required details you need to know before applying

for a personal loan.

| Interest Rate: | 10.50% p.a. onwards |

|---|---|

| Loan Amount: | Up to Rs 7 lakh |

| Tenure: | Up to 60 months |

| Minimum Salary: | Rs 20,000 per month |

| Age: | 18-55 years |

| Processing Fee: | As applicable by Partner |

We aim to make credit accessible for all. Our basic eligibility

criteria allow you to obtain

a personal loan hassle-free. Refer to the criteria below before

proceeding.

18 - 55 years

Indian

You must receive an income in your bank account

Quid provides a fully digital, paperless personal loan application process. You'll need a few essential documents to complete your application. Here's what you need:

Applying for a personal loan couldn’t be simpler! Follow these easy steps to get closer to your personal loan.

Applying for a personal loan couldn’t be simpler! Follow these easy steps to get closer to your personal loan.

Apply for an instant personal loan today in under a minute!

Match Now