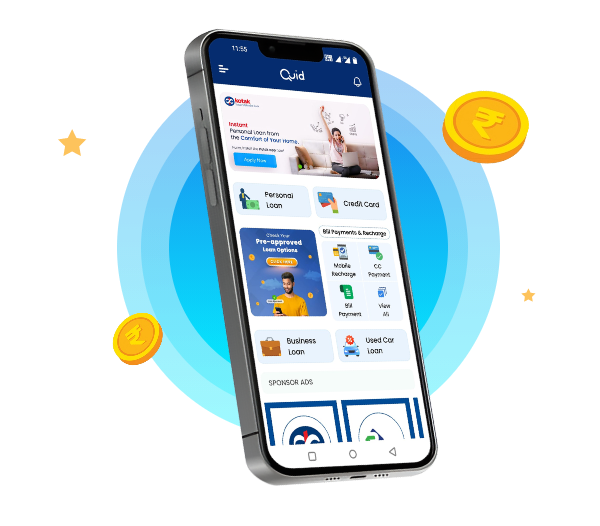

We are the fintech game-changers who identified and found a gateway to empowerment for individuals and businesses. At Quid, we aim to change the notion of being credit-deprived, and through our platform, we seamlessly integrate financial opportunities for all to create a better tomorrow.

A future where seamless access to financial products fosters economic prosperity.

Drive sustainable growth for individuals, banks, and NBFCs through user-centric innovation.

Get credit at first sight and be closer to your goals.

Download Now